Services for Strategic Aviation Operations

Comprehensive coverage and support tailored to turn operational challenges into strategic advantages.

Solving Problems, Creating Strategic Advantage

JetSure isn’t just insurance; it’s a strategic asset designed to empower business aviation professionals to navigate AOG events with confidence and minimal operational disruption. We provide tailored solutions to meet the unique needs of charter operators, aircraft managers, and individual aircraft owners, ensuring a positive experience for your clients and allowing your staff to focus on core business activities.

How JetSure Works

AOG events are unpredictable, but your response doesn’t have to be. JetSure provides a financial safety net, ensuring that when mechanical failures ground an aircraft, your business and clients stay protected.

AOG Incident Occurs

Your aircraft experiences a technical fault that results in an unexpected delay, mid-air diversion, or flight cancellation.

Coverage Activation

With JetSure in place, your financial risk is minimized. You can move quickly to resolve the situation, knowing we’ve got the costs covered.

Seamless Resolution

JetSure helps secure a replacement aircraft, covers key operational expenses, and ensures your clients and crew receive the care they need.

Your Business Thrives

Instead of scrambling for financial solutions, you focus on delivering a smooth recovery, keeping passengers happy and flying.

Make AOG events manageable and predictable.

WHAT JETSURE COVERS

JetSure ensures that when mechanical failures ground your aircraft, your business and clients stay protected. From securing replacement jets to covering key expenses, our coverage minimizes financial impact and keeps operations running smoothly.

Part 91 operators can add crew coverage to their JetSure policy, applicable for mid-air diversion or prolonged delay. JetSure’s AOG support provides your crew with assistance and coverage for their well-being and logistics during these events.

Protect your flights against AOG risks and unexpected costs.

COVERAGE DETAILS

JetSure is designed to help operators recover from unexpected AOG events caused by sudden, unforeseen technical faults. Whether you operate under Part 91 or Part 135, JetSure provides substantial reimbursement for replacement charter costs and passenger disruption expenses—turning an operational emergency into a controlled, professional response.

Part 91 Coverage

Our Part 91 policy is procured by management companies to reduce the cost of a charter when an AOG event forces an owner to use supplemental lift. Policies available to operators by paying an annual deposit premium based on fleet & flight profile.

Coverage Inclusions:

- Policy pays 30% of charter cost

- Policy pays 200% of DOCs to repatriate aircraft

- Includes in-flight medical & tech diversions

- Worldwide coverage for all trips

- Aircraft sourcing by JetSure

- Claims paid within 30 days

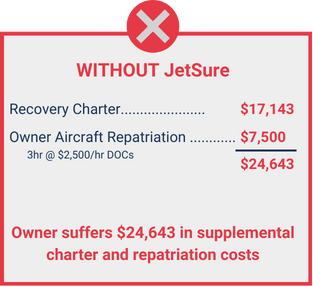

Part 91 Coverage Scenario (JetSure Saves Owner $20,143)

An aircraft owner flies 3 hours outbound on their own aircraft (Part 91). After landing, a mechanical issue grounds the aircraft, and it can’t return in a reasonable timeframe so a replacement charter is required to fly the passenger home. Subsequently, the owner’s aircraft must be ferried back to base.

Part 135 Coverage

Our Part 135 policy is procured by charter operators to protect their charter clients from unexpected AOG-related expenses. Annual policy with a deposit premium adjusted quarterly based on actual charter revenue.

Coverage Inclusions:

- Policy pays up to 50% of the original cost - including replacement charter, client & crew comfort expenditures

- Includes in-flight medical & tech diversions

- Worldwide coverage for all trips

- Aircraft sourcing by JetSure

- Claims paid within 30 days

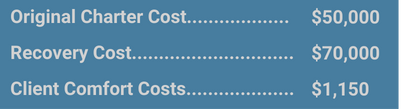

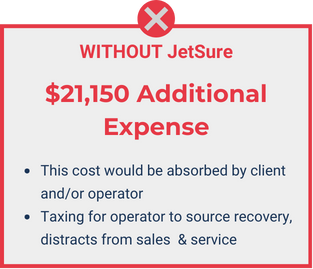

Part 135 Coverage Scenario (JetSure Saves Charter Client $21,150)

A Part 135 operator books a $50,000 charter flight. Prior to departure, the aircraft experiences an AOG. The operator must quickly find a replacement aircraft to keep the trip on schedule and preserve the client relationship. In addition, the delay requires some passenger accommodations—day room hotel access, a meal, ground transportation, and an amenity to soften the inconvenience.

Securing coverage is fast & easy

Getting JetSure protection is simple—so you can focus on flying, not worrying about unexpected costs. With a quick inquiry, personalized quote, and swift coverage activation, you’ll have peace of mind knowing your business and clients are protected when AOG events happen.

Inquire & Customize

Connect with a JetSure specialist. We’ll assess your operations and tailor a coverage plan that fits your needs.

Get a Quote

After reviewing your fleet size, flight volume, and risk profile, we provide a transparent, customized quote with clear coverage terms.

Activate Your Policy

Once you approve the plan, your JetSure coverage goes into effect immediately. You’ll receive all policy details and guidance.

Fly with Confidence

With JetSure in place, you can operate without financial uncertainty, knowing that when disruptions strike, you’re protected.

Protect your flights against AOG risks and unexpected costs.

LEARN MORE ABOUT THE BENEFITS OF JETSURE

Seamless Operations

Keep flights on track and clients satisfied.

Predictable Coverage

Avoid unexpected financial hits from AOG events.

Stronger Client Trust

Deliver a VIP experience, even in disruptions.

Competitive Advantage

Stand out as an operator committed to reliability.